best tax saving strategies for high income earners

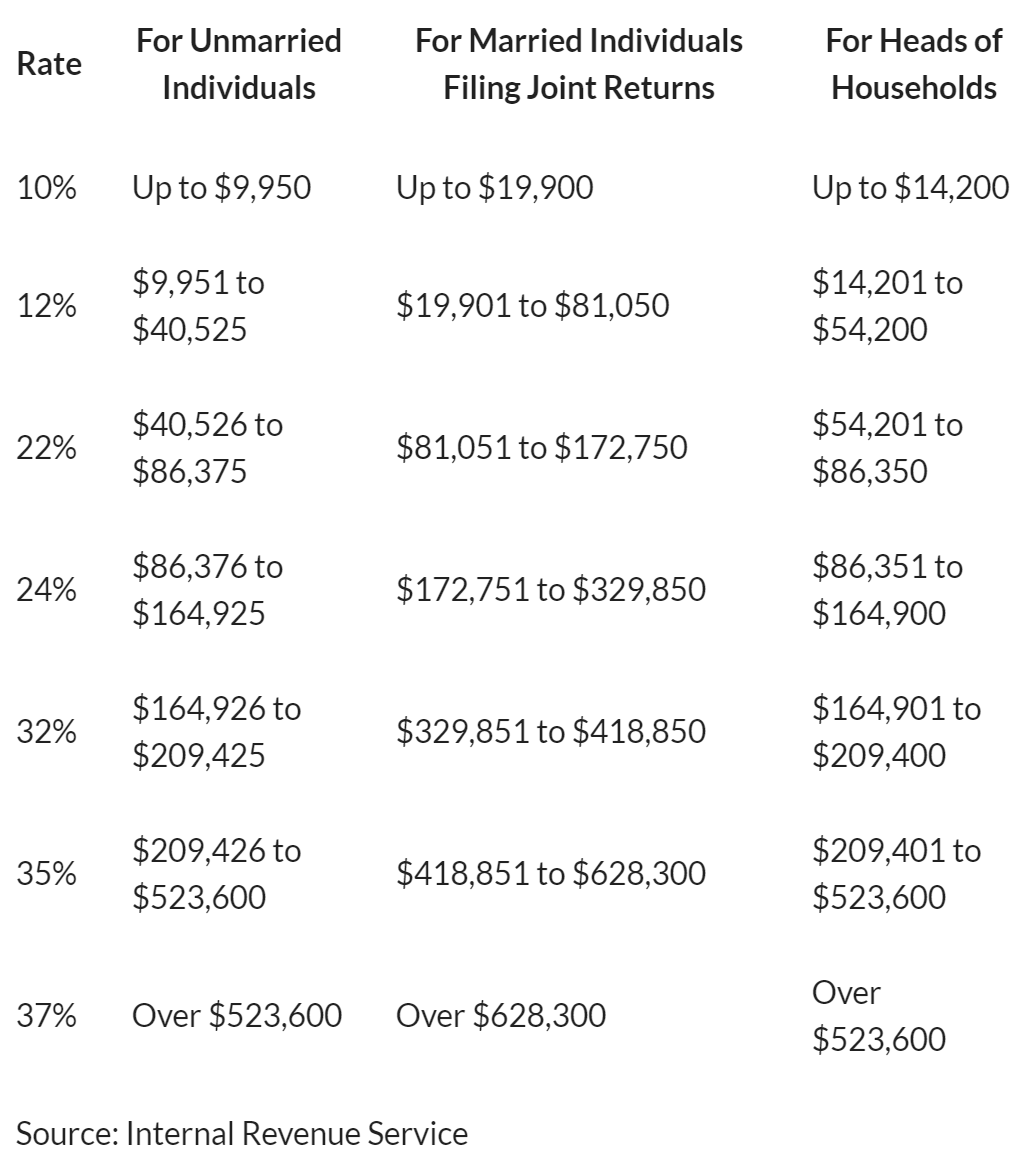

How to Reduce Taxable Income for High Earners. Here Are the Tax Deductions for High-Income Earners That You Can Claim in 2022.

Tax Strategies For High Income Earners Wiser Wealth Management

401 k or 403 b.

. Max Out Your HSA. File With Confidence Today. However lawmakers change tax codes.

Retirement accounts arent the only kind of tax-advantaged savings vehicles. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Do you earn a lot of money.

50 Best Ways to Reduce Taxes for High Income Earners. High earners should invest the maximum in a 401k or 403b. Max Out Retirement Accounts and Employee Benefits.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. Skip Hours Of Tiring Online Research. Here are five tax saving tips.

Ad Answer Simple Questions About Your Life And We Do The Rest. Start Maximizing Your Interest Today. In fact Bonsai Tax can help.

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners. Our tax receipt scanner app will scan. If you run your business from home either as an influencer freelance writer or.

Many people like to lower their current taxable income in the form of pre-tax or Traditional 401k deferrals from their paycheck directly to their employer-sponsored retirement plan. As a high earner your 401k will likely offer the highest contribution cap for tax-deferred retirement savings - making it an important cornerstone of your retirement saving. Ad Open a New Savings Account in Under 5 Min.

Ad Todays Highest Interest Savings Accounts. If you are an employee and you have an employer-sponsored 401 k or 403 b in 2018 you can contribute. Contact a Fidelity Advisor.

Because it allows you to take current and future year contributions. Health savings accounts HSAs allow you to use pre-tax dollars to pay for. Pick From Our List of Money Management Coaches Near You.

Clearly the less income that is taxed the lower your tax bill. Ad Get Advice You Can Trust. This is one of the most efficient tax-saving strategies for high-income earners.

View the Savings Accounts That Have the Highest Interest Rates in 2022. Maximising available allowances Careful consideration of the split of assets between spouses can have a significant beneficial impact on a couples income tax burden. What follows are tax strategies that some high-income earners utilize.

Opening a Solo 401K is Among the Important Tax Saving Strategies for High Income Earners. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. Contact a Fidelity Advisor.

What Are the Tax Strategies of High-Income Earners. Find Which Money Management Coach Fits Your Needs. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

But with big money can come big taxes. Fortunately there are many ways high earners can reduce the taxes on their income. Additionally if you pass it on to your heirs they can also withdraw it without paying any tax.

Tax Strategy For High Income Earners Video In 2021 Retirement Strategies Business Motivation Financial Coach

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

What To Invest In If I M In A High Tax Bracket Tax Efficient Investing Tax Brackets Investing Investing Strategy

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiami Ta Business Tax Llc Business Accounting

5 Outstanding Tax Strategies For High Income Earners

正在为您检查网络环境 Tax Deductions Income Tax Preparation Tax Organization

Tax Strategies For High Income Earners Pillar Wealth Management

Tfsa Vs Rrsp How To Choose Between The Two 2021 Personal Finance Managing Your Money Finances Money

These Are The 7 Mistakes Six Figure Earners Make Saving Habits Financial Success Personal Finance

The Hierarchy Of Tax Preferenced Savings Vehicles

Self Employment Tax Rate Higher Income Investing Dividend Income

How To Create A Social Media Aesthetic Top 5 Useful Tips In 2021 Helpful Hints Social Media Social Networking Sites

Tax Myth 2 Just File An Extension Tax Quote Business Tax Small Business Tax

Tax Strategies For High Income Earners Pillar Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

5 Outstanding Tax Strategies For High Income Earners

High Income Earners Need Specialized Advice Investment Executive